Contents:

We’re the perfect back office solution for professional accounting and bookkeeping services from a reputable Salt Lake City, UT CPA firm. Have you been looking for a bookkeeping service that is tailored to construction industry contractors or subcontractors? We are a team of professionals who specialize in Contractors Bookkeeping Services and understand the unique needs that come with your business. One of our many specialties includes tracking job costs and making sure you are getting paid on time.

Students will be expected to invest a minimum of 24 hours per week for Full-time students , or a minimum of 12 hours per week for Part-time students, on completing coursework. Students will enroll in each course according to the established sequence in the catalog. We understand the unique challenges that come with managing vacation rentals, and we’re here to provide you with personalized support and guidance every step of the way. Working with a remote bookkeeping service will still provide you with all the value you could get from an in-office bookkeeper but at a fraction of the cost.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

Located in North Salt Lake, Utah, Bement & Company is an accounting company. The small team focuses on accounting and business consulting. Provides ongoing tax filing and accounting services for an injury law firm. They make educated recommendations regarding taxes and manage the QuickBooks chart of accounts. Along with our other general bookkeeping services, our skilled, experienced accountants can also act as business planners to provide sound financial advice during important periods and events.

Infinity Tax Solutions

Laruy is prompt, accessible ,and conscientious. I feel fortunate to have found her, and will recommend her professional bookkeeping services to anyone. She has a delightful personality and exceeded my expectations. Lifestyle Bookkeeping offers year-round support.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

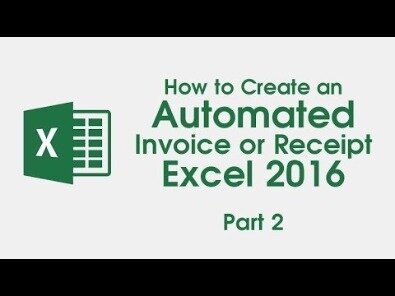

So if you’re looking for a 16 examples of negotiation strategy you can trust, call us for a free consultation. We offer comprehensive accounting and bookkeeping services combined with the attentive and personalized service. You can count on us for accounts payable and receivable, financial statements, month-end closings, bank reconciliations, and much more.

Utah Tax Accountant

Access to this page has been denied because we believe you are using automation tools to browse the website. Build extremely accurate forecasts to predict your success.

SG Tax Service is an accounting company located in West Valley City, Utah. The company provides accounting, business consulting, and translation and has a small team.The company was founded in 1993. Laury is a very competent accountant and good, straight forward communicator. She is very candid about what she can and can’t do and does not string people along as many contract accountants do. She works hard and is, as you would expect from a good accountant, a stickler for detail, yet she is very pleasant and easy to work with. I gladly recommend Laury for outsourced accounting services.

Salt Lake City Bookkeeping

Based in Salt Lake City, Utah, they provide tax preparation, payroll processing, and bookkeeping services for small businesses. Business bookkeeping can be a difficult task for any business owner — even those who claim to know their company like the back of their hand. There are daily tasks that need to be completed accurately to make sure that the company’s finances are properly organized and that operations are running on all cylinders. With so many other things to do, are you sure you have the time and resources to adequately manage your business bookkeeping? Get the professional assistance that you need by contacting the freelance bookkeepers at Business Bookkeeping, LLC.

Tax packages include tax prep, filing, and consulting, too. Xendoo’s online tools work with your platforms to give you up-to-date financial reports when you need them. An in-house, US-based team with years of experience in a variety of industries including restaurants, fitness centers, bars, real estate, and more.

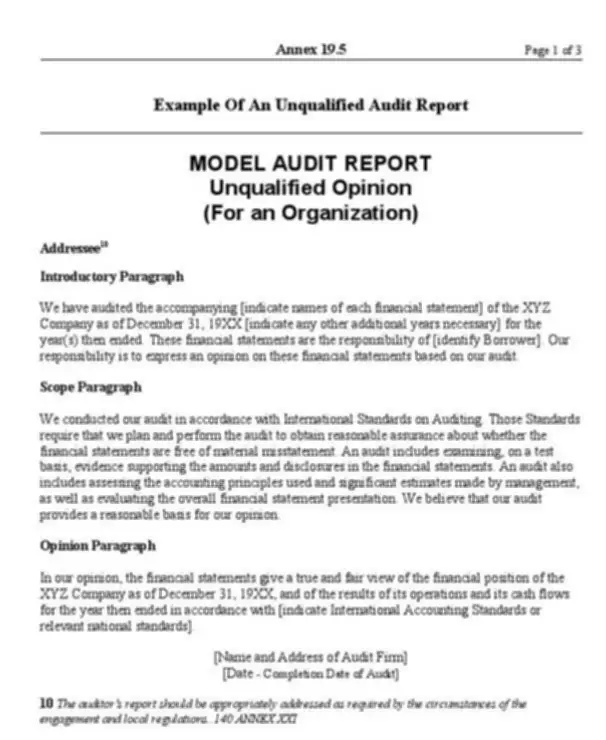

Webinar: Challenges for the Small Firm – CPAPracticeAdvisor.com

Webinar: Challenges for the Small Firm.

Posted: Wed, 07 Dec 2022 08:00:00 GMT [source]

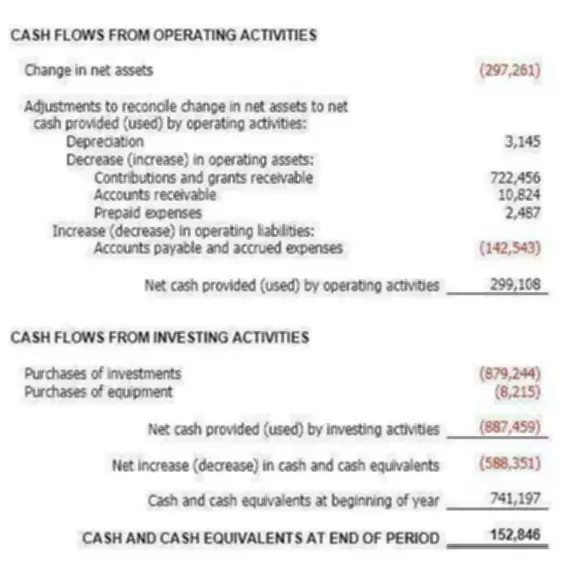

Since every transaction flows through the general ledger, a problem with your general ledger throws off all your books. Track dramatic increases in product returns or cost of goods sold as a percentage of sales. Proper management of funds not only saves money, it makes money for you.

The entire Staff at Food https://bookkeeping-reviews.com/ Supply in Salt lake can’t express how grateful we are to have found and trusted Tyler and the professional staff at Special Bookkeepers. Tyler took on our books which were in poor shape and in less than 4 months provided a level of detailed reporting and accuracy that many were telling us would take years to achieve. Enjoy convenient and secure online and in-person communication for easy access to your key financial information and important updates. We create customized bookkeeping systems to meet your needs and exceed your expectations…. GET THE QUICKBOOKS HELP YOU NEED, CALL NOW FOR A FREE CONSULTATION!

Anyone can utilize bookkeeping for small and medium businesses, as we provide many other services. Launched in 2016, Infinity Tax Solutions is an accounting company. They are located in Salt Lake City, Utah and have a small team. The agency provides accounting and business consulting. Reconciling your accounts each month can be time consuming and tedious. If you’re looking for a professional who can handle this task for you, consider hiring Bookkeeping for Contractors.

Their team specializes in accounting and business consulting. Accounting company Smith Powell & Company was launched in 1912. The company offers accounting and business consulting and has a small team.

GALLINA LLP is an accounting company located in San Jose, California; Novato, California; San Bruno, California and Midvale, Utah. Launched in 1955, the midsize team focuses on accounting. Originally from northern Virginia, Laury moved to Utah 20 years ago and loves all that the Salt Lake area has to offer. She has over 25 years in accounting and business experience, and specializes i… Today I was notified that one of my clients, SLC Bookkeeping attended a webinar based on Marketing for Accountants.

Xendoo moves quickly so you can make informed decisions faster. Xendoo online bookkeeping services will provide you a profit & loss statement, plus a balance sheet at the close of each month and a dashboard that shows your business trends over time. Elevation Tax Group is a West Jordan, Utah-based accounting company. Sonnenburg Consulting is a business consultancy based out of South Jordan, Utah.